- Get link

- X

- Other Apps

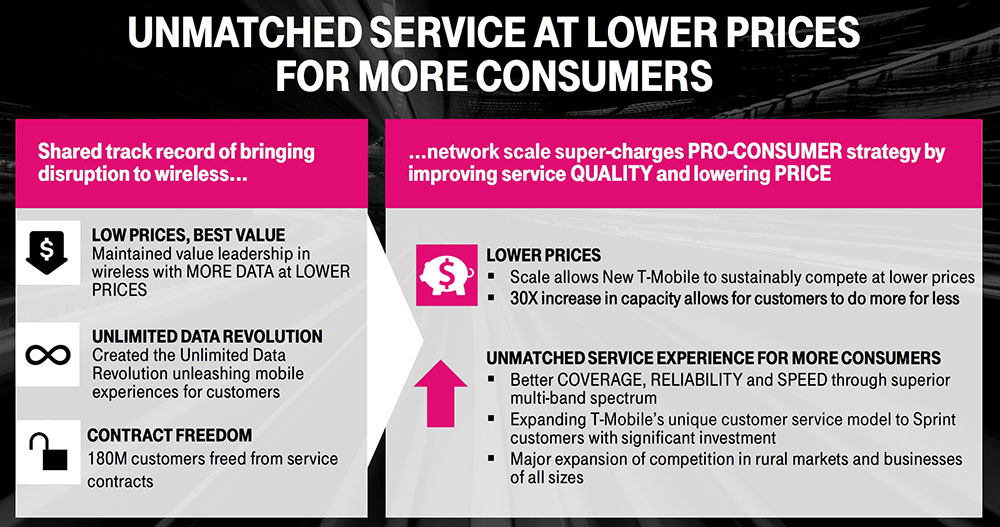

Some experts fear that this consolidation will decrease competition and raise prices. Four-to-three mergers deservedly raise eyebrows and evidence from other countries showed that 4-3 mergers in the wireless market would increase prices.

T Mobile And Sprint Win In Court Companies Moving To Finalize Merger To Create New Supercharged Un Carrier T Mobile Newsroom

T Mobile And Sprint Win In Court Companies Moving To Finalize Merger To Create New Supercharged Un Carrier T Mobile Newsroom

The Sprint brand was discontinued on August 2 2020.

T mobile sprint merger price. With the closing of T-Mobile and Sprints 30 billion thats 30000 millions deal there will basically be just three choices for mobile consumers. The German telecoms company which owns more than 60 of T-Mobile US is seeking a reduced purchase price for Sprint because the companys share price and performance have deteriorated since. The deal would value Sprint at 662 per share based on T-Mobiles closing price Friday.

As such T-Mobile claims the pricing structure for. Sprint and T-Mobile have moved yet another step closer to a merger and it could lead to consumers paying more for wireless plans. Due to its underdog status Sprint has been having the best plan price promos for a few years now including a 20 per line.

Meanwhile were working on ways to make it easy to migrate Sprint customers who wish to do so stay tuned. The short answer is yes you can keep your current inexpensive Sprint plan and take advantage of the new 5G network powers after the merger with T-Mobile. Sprint Corporation and T-Mobile US merged in 2020 in an all shares deal for 26 billion.

The combined assets of T-Mobile and Sprint are so complementary that the merger is expected to unlock at least 43 billion in synergies for all shareholders. With the T-Mobile Network Experience. The T-MobileSprint merger presented a harmful 4-to-3 combination in the critical and well-defined market of mobile wireless services.

The FCC and the Justice Department last year approved the merger with conditions including Dish Network buying Sprints prepaid businesses and acquiring 39 billion in spectrum. A federal judge in New York on Tuesday approved the 265-billion. After a two year long approval process the merger closed on April 1 2020 with T-Mobile emerging as the surviving brand.

Under the terms of the transaction Sprint shareholders will receive a fixed exchange ratio of 010256 T-Mobile shares for each Sprint share Multiply the number of shares tendered times 10256 for the number of shares of T-Moblie received including the fraction of a share. In April 2018 John Legere the CEO of T-Mobile NASDAQTMUS made the long-expected announcement that T-Mobile and Sprint NYSES had reached an agreement to merge in a 26 billion. Tom Young SuperUser.

Both Sprint and T-Mobile customers will continue to get great coverage and over time the two networks will combine to create one supercharged network. T-Mobile Sprint have signed a merger agreement that will be announced Sunday. For now customers will use two distinct networks Sprint and T-Mobile.

While not everyone appears to be buying Magentas explanation this does make sense as the average price of a new smartphone device has indeed risen consistently in the last few years with many new flagship devices now costing over 1000 which was pretty much forbidden land not long ago. New York CNN Business The 26 billion merger between T-Mobile and Sprint has been approved ending a years-long attempt to combine the United States third-. Sprint merged with T-Mobile in 2020 and customers who were on Sprint plans have been able to remain on their plans and continue to use the Sprint network while the networks and infrastructure are integrated - a multi-year process.

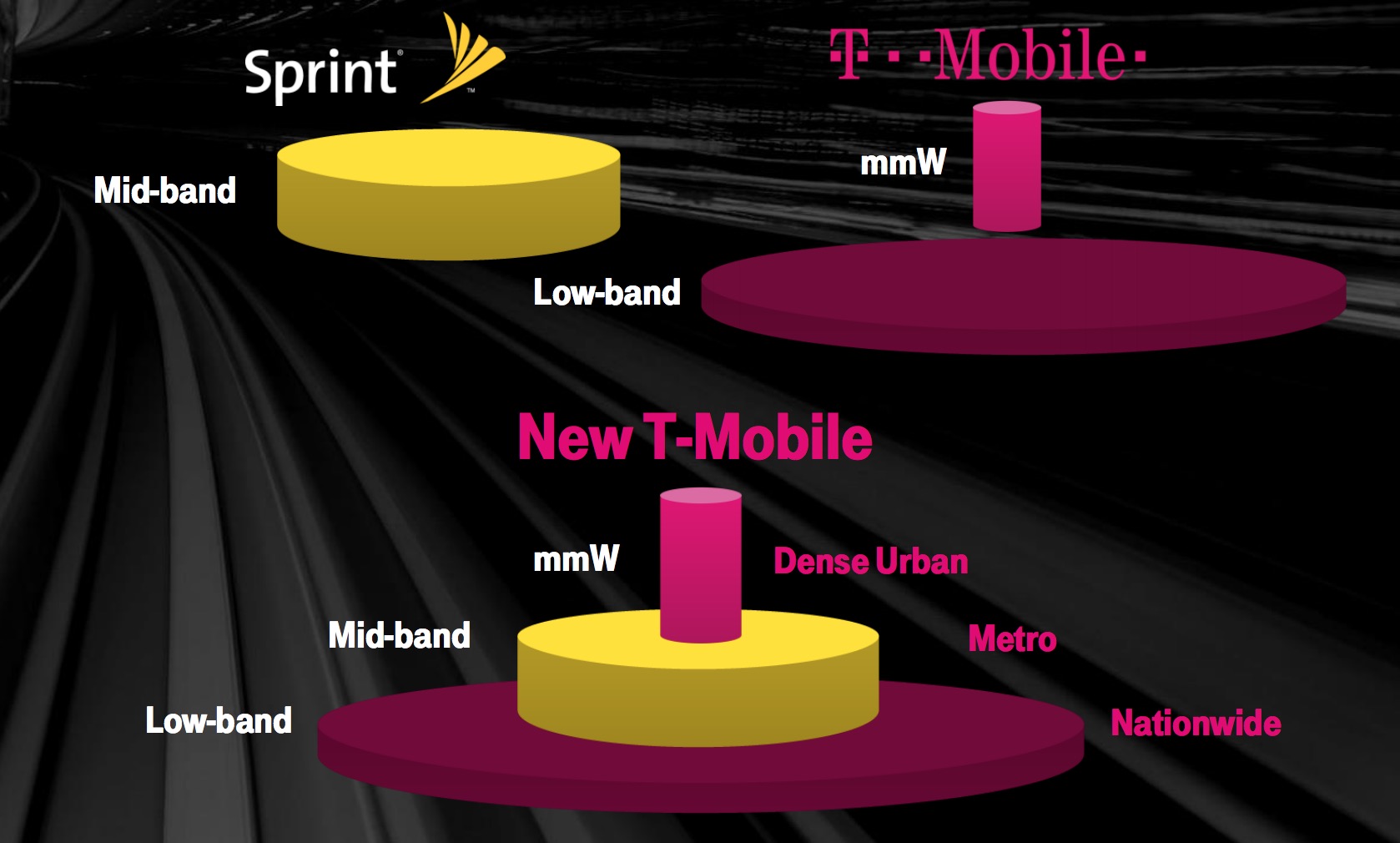

The vast majority of synergies in this deal come from combining networks such as reducing redundant cell sites and rapidly deploying spectrum and other technologies more efficiently. Eligible Sprint customers can now take advantage of the full T-Mobile network with a simple SIM swap. The combined assets of T-Mobile and Sprint are so complementary that the merger is expected to unlock at least 43 billion in synergies for all shareholders.

The deal was announced on April 29 2018. T-Mobiles asset-tracking solution costs 10 per device per month. But as part of that integration between Sprint and T-Mobile customers on legacy Sprint accounts will begin to see some pricing and hotspot data.

The vast majority of synergies in this deal come from combining networks such as reducing redundant cell sites and rapidly deploying spectrum and other technologies more efficiently. Your Sprint account remains the same with the same price plan and billing experience but now youll access the T-Mobile network as your primary network. T-Mobile generated 111 billion in revenue in the first quarter representing an.

So This T Mobile Sprint Merger

So This T Mobile Sprint Merger

T Mobile Sprint 26 Billion Merger Cleared After Court Ruling Variety

T Mobile Sprint 26 Billion Merger Cleared After Court Ruling Variety

Merger Of Sprint Corporation And T Mobile Us Wikipedia

Merger Of Sprint Corporation And T Mobile Us Wikipedia

/cdn.vox-cdn.com/uploads/chorus_image/image/63052972/acasatro_180430_1777_sprint_Tmobile_0003.0.jpg) The T Mobile Sprint Merger Is A Dizzying Deal For Regulators The Verge

The T Mobile Sprint Merger Is A Dizzying Deal For Regulators The Verge

So This T Mobile Sprint Merger

So This T Mobile Sprint Merger

Softbank Is In Big Trouble If Sprint T Mobile Merger Doesn T Happen

Softbank Is In Big Trouble If Sprint T Mobile Merger Doesn T Happen

T Mobile And Sprint Are Merging Here S Everything You Need To Know Cnet

T Mobile And Sprint Are Merging Here S Everything You Need To Know Cnet

/cdn.vox-cdn.com/uploads/chorus_image/image/63002408/tmo-sprint-merger.0.png) T Mobile Steps Up Lobbying Over Sprint Merger Promises Not To Raise Rates The Verge

T Mobile Steps Up Lobbying Over Sprint Merger Promises Not To Raise Rates The Verge

T Mobile Sprint Merger What It Means

T Mobile And Sprint Merger Gets Green Light From Judge Sprint Stock Jumps 60 9to5mac

T Mobile And Sprint Merger Gets Green Light From Judge Sprint Stock Jumps 60 9to5mac

The Complete Story Of How T Mobile Finally Reached A Merger Agreement With Sprint Fiercewireless

The Complete Story Of How T Mobile Finally Reached A Merger Agreement With Sprint Fiercewireless

The T Mobile Sprint Merger Is Complete What Does It Mean For Customers

The T Mobile Sprint Merger Is Complete What Does It Mean For Customers

T Mobile Agrees To Acquire Sprint For 26 Billion Venturebeat

T Mobile Agrees To Acquire Sprint For 26 Billion Venturebeat

Comments

Post a Comment