- Get link

- X

- Other Apps

What is the offer price range for the offering. At what price shall the retail investor subscribe.

This enabled Saudi Arabia to deliver on MBSs objective of an optically high price but at the cost of mostly skipping international capital.

Saudi aramco ipo. The Saudi Aramco IPO retail subscription period is commencing and running concurrently with Institutional Book-building. This amount was only 15 of the companys value significantly lower than. Managing some of the largest proven reservoirs in the world demands extraordinary capabilities.

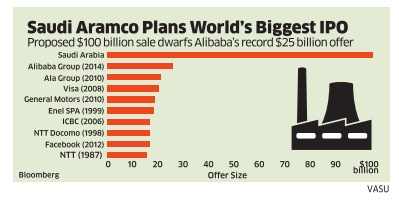

Saudi Aramco IPO In 2019 Aramco went public with an IPO raising a record 25 billion by selling three billion shares. Saudi Aramcos IPO Oversubscribed Reels In 44 Billion. Therefore at the beginning of the retail subscription period the only reference point will be the announced offer price range.

PIF can reach SR4 trillion in. Enter Dammam-7 Aramcos new supercomputer and the most powerful computing system in the. Saudi shareholders are still dependent on Aramcos performance just through a different mechanism.

The price gives Aramco a valuation of 188 trillion and makes it the largest listed company in. DUBAI Reuters - Saudi Aramco has hired nine banks as joint global coordinators to lead its planned initial public offering IPO slated to be the worlds largest two sources familiar with. Any offer to acquire shares pursuant to the proposed offering the Offering or the IPO will be made and any investor should make his investment decision solely on the basis of the information that is contained in the prospectus the Prospectus to be published by Saudi Arabian Oil Company Saudi Aramco the Company or Saudi Aramco in due course in connection with the listing Listing of.

Therefore at the beginning of the retail subscription period the only reference point will be the announced offer price range. Why hold the IPO then. The latter was less likely to overlook Aramcos state ownership and would therefore have sought a discount.

The sophisticated supercomputer opening up new frontiers. Saudi Arabias oil giant Aramco has attracted total bids of US443 billion for its initial public offeringor 17 times the money. Saudi Aramco has withdrawn from IPO roadshows in the US and London after its likely they dont want to disclose oil reserve totals to Western banks and regulatorsBesides the US and London the IPO roadshow was also canceled in Canada.

Aramco could sell more shares to benefit PIF Saudi crown prince tells FII Second IPO could be reinvested for the benefit of Saudi citizens Mohammed bin Salman. The Saudi Aramco IPO retail subscription period is commencing and running concurrently with Institutional Book-building. Scheduled to become an IPO in 2018 Aramco is on the verge of becoming the largest IPO on the market.

Saudi Aramco shares surge 10 as historic IPO begins trading Shares of the state-owned oil company rose to 352 Saudi riyals 938 from 32 riyals in early deals in Riyadh up 10. Aramcos IPO in December 2019 was the biggest ever but also confined to the small domestic market. The Aramco IPO will still be the worlds largest but by an eyelash instead of a landslide.

The IPO values Aramco at roughly 17 trillion making it the most valuable publicly traded company in the world ahead of Apple AAPL which is worth about 115 trillion. But that valuation may end up being slashed by up to 40 when it. Bankers for Saudi Aramcos IPO have dangled the possibility of bonus payouts to investors that could top 100bn.

Aramco became a significant part of the MSCI Saudi Arabia index meaning global fund managers tracking the index will be under pressure to buy the shares. Demand during the bookbuilding period for Aramcos IPO reached 106 billion with most of that generated by Saudi investment. This book discusses the strategic shift in ownership of Aramco the Saudi Arabian Oil Company and its potential impact on Aramcos role in a post- privatized world.

Saudi Arabias state-owned oil company Saudi Aramco has valued its coming IPO as high as 2 trillion.

Saudi Aramco Ipo Oil Giant Nears 2trn Valuation Despite Climate Fears Business Live Business The Guardian

Saudi Aramco Ipo Oil Giant Nears 2trn Valuation Despite Climate Fears Business Live Business The Guardian

Saudi Aramco Ipo All You Need To Know Aramco Initial Public Offering

Saudi Aramco Ipo All You Need To Know Aramco Initial Public Offering

Saudi Arabia Cancelled Aramco Ipo Disbands Advisers Commonwealth Union

Saudi Arabia Cancelled Aramco Ipo Disbands Advisers Commonwealth Union

Medirections Blog Geopolitics And Conflicts Hit Aramco S Ipo Crown Prince Turns East Medirections Blog

Medirections Blog Geopolitics And Conflicts Hit Aramco S Ipo Crown Prince Turns East Medirections Blog

Saudi Aramco News First Big Test After Massive Ipo Bloomberg

Saudi Aramco News First Big Test After Massive Ipo Bloomberg

Aramco Ipo Bids Reach 44 3 Billion As Retail Offer Closes Bloomberg

Aramco Ipo Bids Reach 44 3 Billion As Retail Offer Closes Bloomberg

What S Wrong With The Saudi Aramco Ipo Planet Money Npr

What S Wrong With The Saudi Aramco Ipo Planet Money Npr

Saudi Aramco Ipo May Drag Real Estate Prices Down Arab News

Saudi Aramco Ipo May Drag Real Estate Prices Down Arab News

Saudi Aramco Ipo Valuation Is Less Than Hoped For But Vision 2030 Now Starts In Earnest Hellenic Shipping News Worldwide

Saudi Aramco Ipo Valuation Is Less Than Hoped For But Vision 2030 Now Starts In Earnest Hellenic Shipping News Worldwide

Aramco Ipo Retail Subscription At 5 8 Bln Says Lead Manager Voice Of America English

Aramco Ipo Retail Subscription At 5 8 Bln Says Lead Manager Voice Of America English

The Saudi Aramco Ipo Breaks Records But Falls Short Of Expectations

The Saudi Aramco Ipo Breaks Records But Falls Short Of Expectations

How Saudi Aramco Ipo Proved A Game Changer In A Tumultuous Year For Oil Arab News

How Saudi Aramco Ipo Proved A Game Changer In A Tumultuous Year For Oil Arab News

Saudi Aramco Upsizes Its Record Shattering Ipo By 3 8 Billion

Saudi Aramco Upsizes Its Record Shattering Ipo By 3 8 Billion

Comments

Post a Comment