- Get link

- X

- Other Apps

Alone 130928 credit card fraud reports were recorded that year according to DataProt. Even though you havent completed the transaction the portion of your credit thats blocked no longer is available for other charges.

I Experienced A Type Of Credit Card Fraud I Didn T Know Existed One Mile At A Time

I Experienced A Type Of Credit Card Fraud I Didn T Know Existed One Mile At A Time

For a long time credit card companies cell phone companies and banks have been able to utilize incredibly powerful computers that use machine learningdata science to retain you Dell says.

Block company from charging credit card. Our objective is to give consumers that powerful tool or engine. For example there is a case of seizure of account balance of the people in Cyprus that had a portion of. On blockchain platforms your payments cant be blocked and also your balances cant be seized.

Youre entitled to protection under the Fair Credit Billing Act. You can also call your creditor and. You would have to contact your credit card issuer for assistance if you are unable to communicate with the seller.

This tends to be quite common in the credit card transactions as most of the companies are not compliant to laws and legal abidance. When calling your credit card company be prepared to offer your account number billing amounts and billing dates. Your card issuer has no right to insist that you ask the company taking the payment first.

The average consumer is not able to avail themselves with an equally powerful engine to help them navigate their financial choices. Youll have 60 days to dispute the charge starting when the card. To cancel a credit card transaction contact either the merchant on the other side of the transaction or the credit card company.

This can prove especially inconvenient if the merchant places a larger hold than you intend to use as your card then may have less purchasing power than you think. Call your credit card provider. The worldwide cost of credit card fraud in 2018 was 2426 billion and in the US.

Send an automatic payment cancellation. I am 999 sure I turned off auto renew beforehand but I cant go back and check because like I said I dont have any of the account information anymore. Once you do this the brand will not be able to charge your card again and youll need to unblock it to continue shopping with that merchant.

You will be sent a new card with a new number. But what happens when they mistake you for the thief. It will notate your account and freeze the transaction which frees up the disputer credit line and blocks interest and payment requirements until the dispute is resolved.

Under the federal Fair Credit Billing Act shoppers can petition their bank to reverse charges on a credit card for several reasons including if the charge is fraudulent or the item was not what the shopper originally ordered. Merchants must issue a credit to settle legitimate consumer claims. The card processing companies impose fines on retailers with charge-back ratios that are considered.

So I cant log. They cant prevent a charge from happening if the credit card itself is valid and as far as I know they cant block a merchant for one customer. As for having to pay it back youre not going to get off that easily.

Dont know the email account name password none of it. If the card is physically present call the number on the back of your card. According to the Federal Reserve the credit card charge-off rate rose to more than 38 in the first quarter of.

When asking the company charging you to stop doesnt work and if the credit card company wont block it for you you can resort to reporting your card lost. They can blacklist but that will have to be MC and not your issuer and it will be for all customers on the MC network. But if the vendor continues to charge your credit card contact your card issuer.

When company blocks your credit card it places a hold on your credit line for the estimated amount of your final bill. Blockchain Payments Cant be Seized Stopped or Blocked. I just got charged 10 for a monthly subscription for an account that I dont have access to.

Stopping an automatic recurring payment on a credit card is different. Many credit issuers allow customers to temporarily block a missing card. Therefore always cancel through the vendor first and use a credit card block to protect against subsequent charges.

When your credit card company stops a thief from charging fraudulent expenses to your card youre thrilled. The offending charges will fail the next time they try to use the old number. Can you block a company from charging your debit card.

You can generally do this online over the phone or by stopping by a bank branch. Otherwise look for the number on your credit card statement or. Lock your card.

To withdraw consent simply tell whoever issued your card the bank building society or credit card company that you dont want the payment to be made. Tap into your transaction history and locate the last charge from the merchant. I doubt thats possible.

You can tell the card issuer by phone email or letter. If this is a possibility use it. If you suspect your debit card will be used fraudulently or if you cannot stop an automatic payment you have scheduled with a merchant it is possible to block debit card transactions by contacting your bank.

Tap the transaction and then tap Block Brand below the receipt number. Can you block a company from charging recurring payments. If the sellers web site is using PayPal Pro you cannot stop the subscription via your PayPal Account as the seller has your credit card info and can simply keep charging you.

Write to your card issuer and demand that the rogue payments be stopped if it fails to act. Start by putting in your request with the vendor. On the contrary a credit card charge off means you are more than 180 days late on your payment and the credit issuer considers the debt uncollectible.

If your creditor offers this feature visit their website or open your mobile app. Some cards let you lock or freeze your credit card online or through your mobile app. They have to stop the payments if you ask them to.

Which you should contact first depends on whether or not you think the transaction is fraudulent. Credit card charge offs are on the rise in recent months. Follow up the written dispute with a call to your credit cards customer service department as listed on the back of your card.

8 Best Credit Card Payment Processing Companies For 2021

8 Best Credit Card Payment Processing Companies For 2021

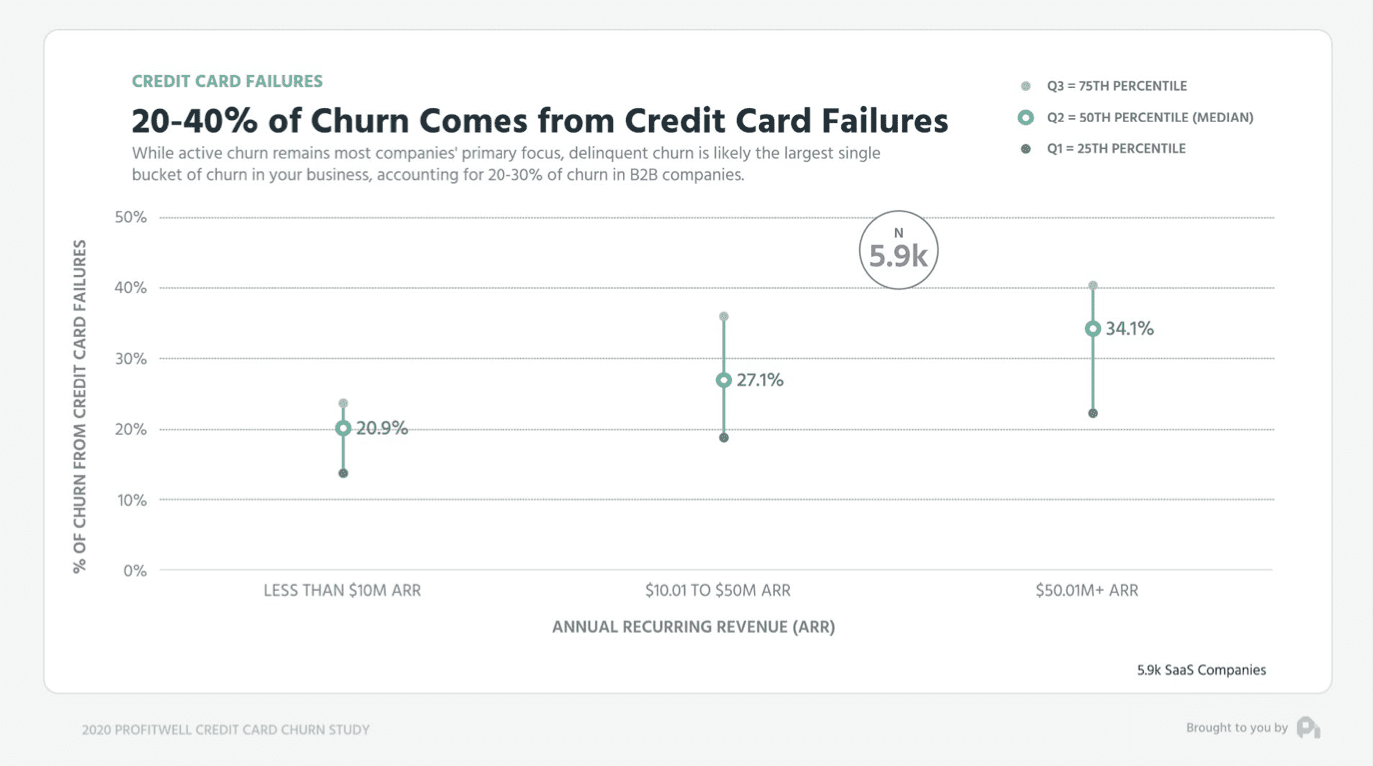

What Is Dunning Management Why Should You Care As A Saas Company Chargebee S Saas Dispatch

What Is Dunning Management Why Should You Care As A Saas Company Chargebee S Saas Dispatch

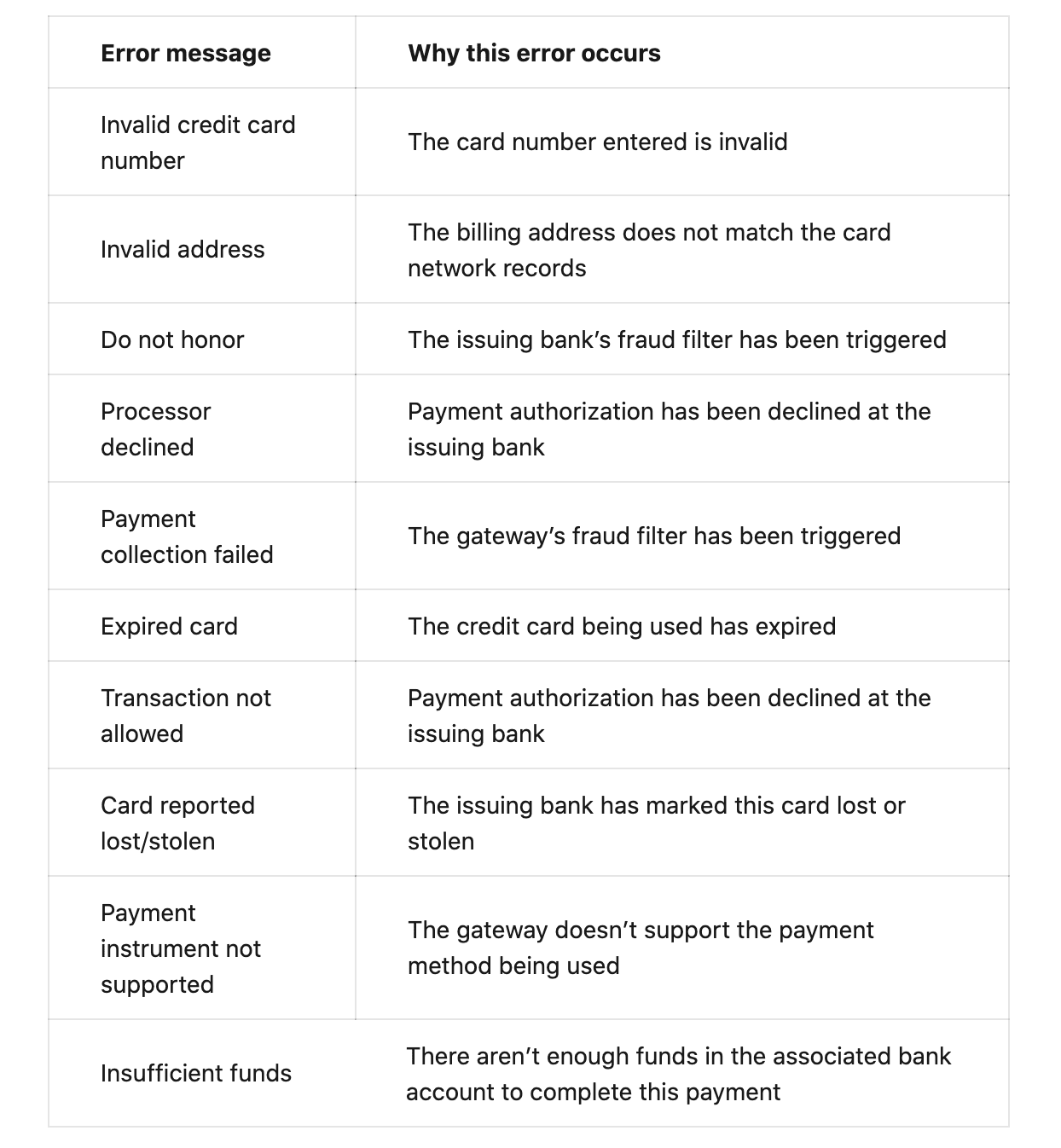

Credit Card Decline Messages Everything You Need To Know

Credit Card Decline Messages Everything You Need To Know

Can I Block A Certain Company From Charging My Credit Card Quora

3 Things To Know About How Credit Card Refunds Work

When Will I Get My Hire Car Deposit Back Rentalcars Com

When Will I Get My Hire Car Deposit Back Rentalcars Com

How To Prevent And Reduce Credit Card Fraud By 98 Using Stripe Radar

How To Prevent And Reduce Credit Card Fraud By 98 Using Stripe Radar

Why Do You Need A Credit Card To Hire A Car And What If You Don T Have One Rentalcars Com

Why Do You Need A Credit Card To Hire A Car And What If You Don T Have One Rentalcars Com

Visa Credit Card Security Fraud Protection Visa

Visa Credit Card Security Fraud Protection Visa

Here S How To Reverse Your Credit Card Transactions

Here S How To Reverse Your Credit Card Transactions

Why Do You Need A Credit Card To Hire A Car And What If You Don T Have One Rentalcars Com

Why Do You Need A Credit Card To Hire A Car And What If You Don T Have One Rentalcars Com

Credit Card Decline Messages Everything You Need To Know

Credit Card Decline Messages Everything You Need To Know

:max_bytes(150000):strip_icc()/101832322.credit.cards.wallet.resized-5c1172dac9e77c00019d8263.jpg)

Comments

Post a Comment