- Get link

- X

- Other Apps

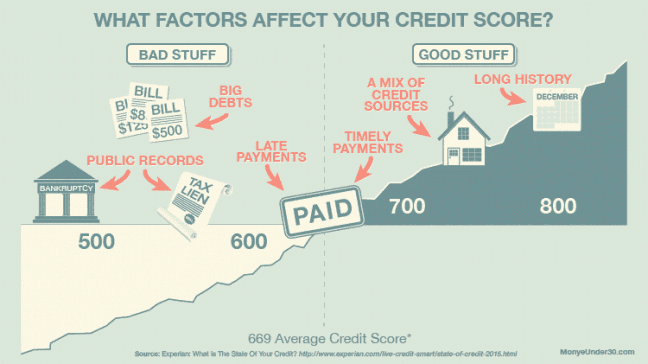

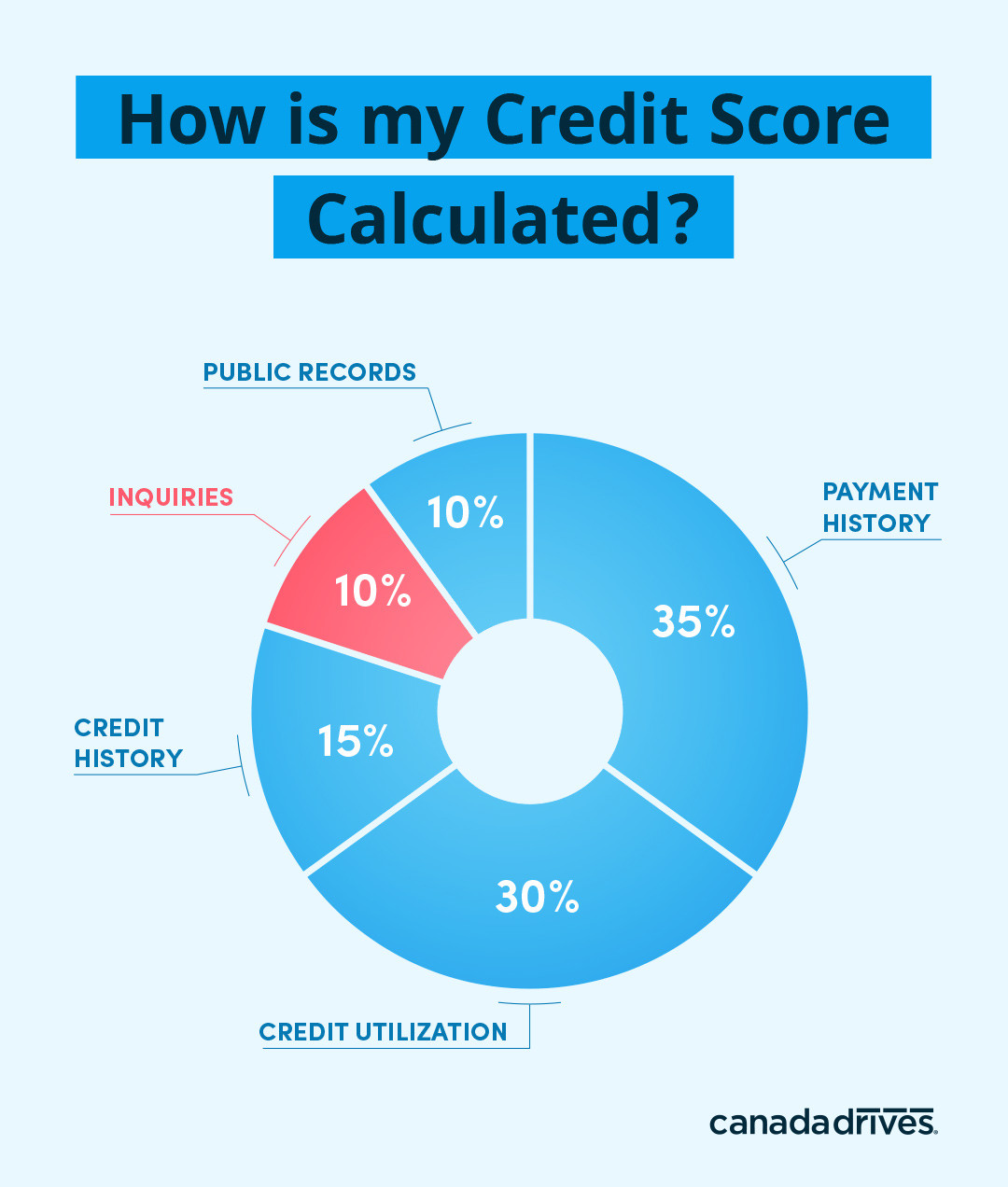

But according to FICO if you have a short credit history or few accounts it could hurt more. Your payment history is the biggest factor in your credit scores.

How Many Points Does A Hard Inquiry Affect My Credit Score Nav

How Many Points Does A Hard Inquiry Affect My Credit Score Nav

Nothing else had changed on my credit report from before the time.

Does running credit check lower score. In most cases however an occasional hard credit check will. Credit denials do not affect your score Whether its your rental application thats been denied or a credit card mortgage or other type of loan your credit report will never indicate your request for credit has been declined. Is this advice even valid.

Your customers can use those statements to take steps to improve their. Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores. There are two main parts of the.

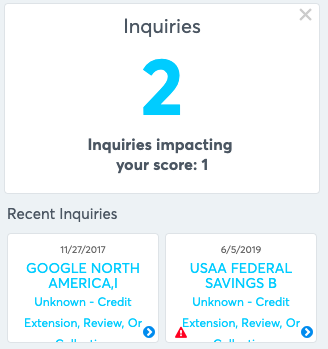

Either way youll see an inquiry on your credit report. And since its not in your credit report it wont affect your credit score. What these well-intentioned folks are probably trying to warn you about is the possibility that your credit score will take a hit when an inquiry is made into your credit report.

And while that may be true in some instances it isnt always the case. How FICO bundles inquiries. Soft inquiries never affect scores.

And because I check my credit score regularly I was able to see the inquirys impact. Hard inquiries in response to a credit application do impact credit scores. They come from credit checks that dont come from credit applications.

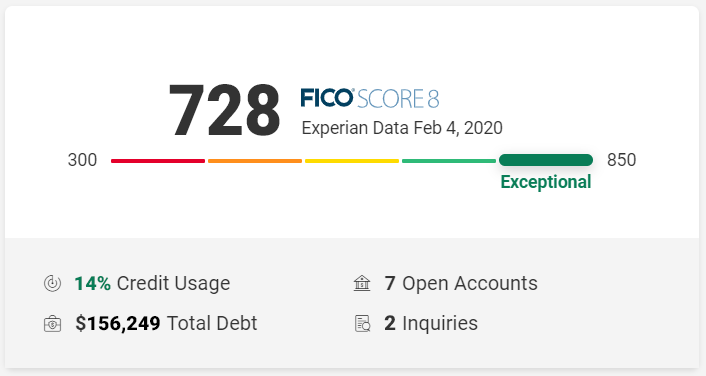

In fact its essential to regularly check your score so you can track how different credit activities impact the number. Keep your credit card balances low. No checking your credit score does not lower your score.

But if a lender or credit card issuer does it might. Lets focus now on how FICO credit scores essentially treat multiple hard inquiries as one. Those credit score risk factors are specific to the individuals personal credit report and will help them identify the steps they need to take to become more creditworthy.

Your utilization rate is also an important factor in credit scores. Its worth noting the differences however so you can go. Regularly checking your credit reports and credit scores is a good way to ensure information is accurate.

While hard inquiries lower your score they do so by a very small margin -- typically no more than five points. There are often mistakes or things the tenant was unaware of but is willing to fix. It means that someone.

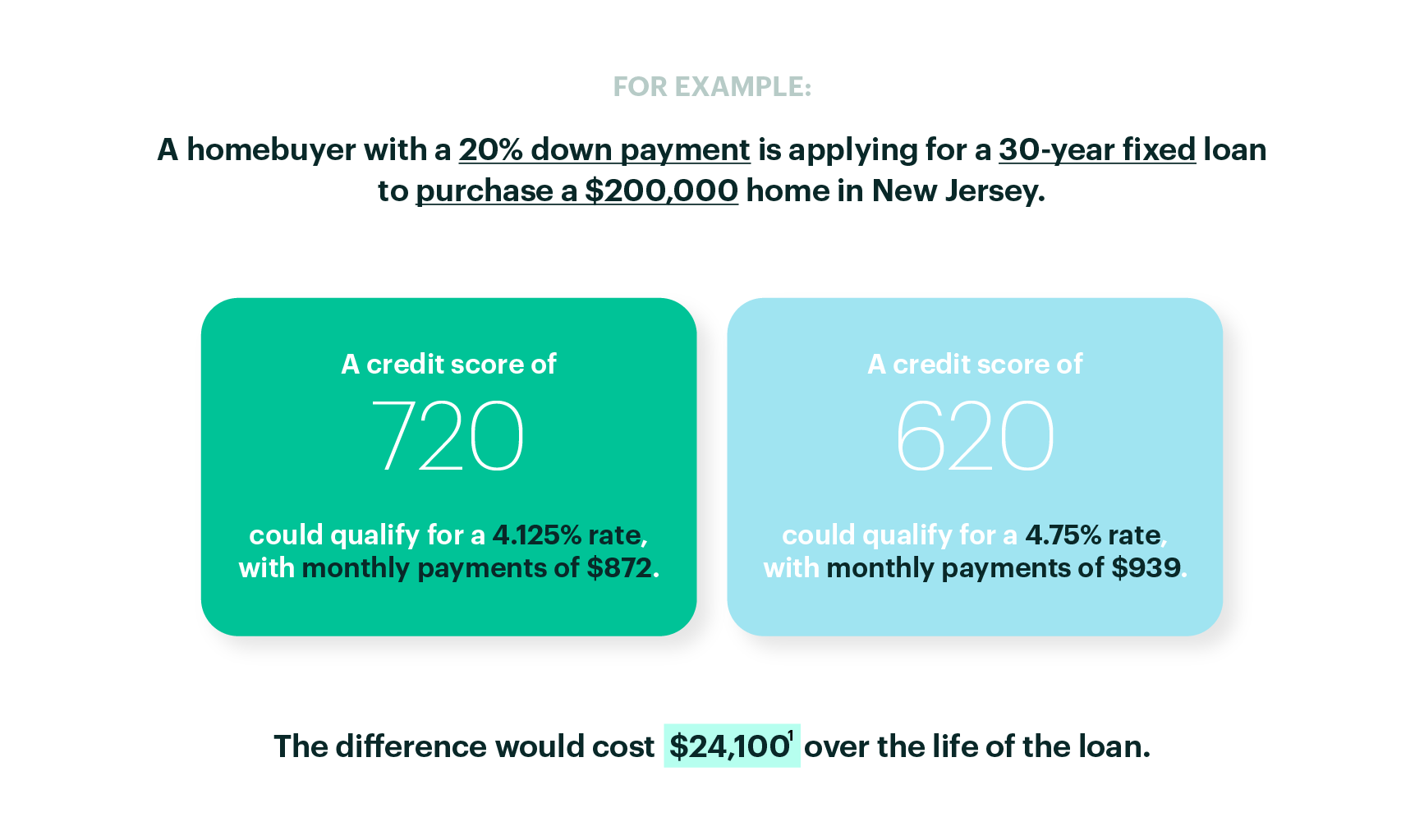

Your credit score is a 3-digit number that basically sums up that information into a rating. Checking your credit reports or credit scores will not impact credit scores. It sent my score down just eight points.

Some good renters may have had hard times in the past but are working to improve their credit. In most cases a hard credit inquiry usually reduces your credit score by less than five points. Consider allowing your finance manager to share the credit score risk factor statements with your customers when they pull their credit for lending purposes.

But does your credit score drop when someone checks it. If you run a credit check on a tenant and they have a low score be sure to carefully review the credit report. The lower your balances on revolving accounts the lower your utilization rate will be.

A good credit score means youre a good credit risk more likely to repay a loan whereas a low credit. Low utilization rates are good for credit scores. However if a lender checks your credit score that action may temporarily lower your score.

Soft credit checks do not have any impact on your credit score but hard credit checks can reduce your score. If you check your credit score yourself it doesnt lower it. The best thing you can do for your scores is to make sure every payment is on time and to bring any past due accounts current.

That does not mean that you should refrain from applying for an apartment you like simply because the apartment manager notes his intention to conduct a hard credit inquiry. Examples include preapproved card offers insurance-premium renewals and consumer requests for their own credit reports.

Do Multiple Credit Checks Affect Your Credit Score Tigermobiles Com

Do Multiple Credit Checks Affect Your Credit Score Tigermobiles Com

Does Checking Your Credit Hurt Your Credit Score

Does Checking Your Credit Hurt Your Credit Score

How Credit Works Understand Your Credit Report And Score

How Credit Works Understand Your Credit Report And Score

How Do You Check Your Credit Score Experian

How Do You Check Your Credit Score Experian

Do Credit Checks Hurt Your Credit Score

Do Credit Checks Hurt Your Credit Score

Credit Reports And Scores Usagov

Credit Reports And Scores Usagov

Do Student Loans Affect Your Credit Credit Com

Tenant Screening Credit Reports And Background Checks Free For Landlords Cozy

Tenant Screening Credit Reports And Background Checks Free For Landlords Cozy

Does Checking Your Credit Score Lower It Quora

Does Checking Your Credit Hurt Your Credit Score

Does Checking Your Credit Hurt Your Credit Score

How To Run A Credit Check On A Tenant Zillow Rental Manager

How To Run A Credit Check On A Tenant Zillow Rental Manager

/credit-score-checking-d6115f7a65154cdcb80977341f5f2960.jpg) Does Checking Your Credit Score Lower It

Does Checking Your Credit Score Lower It

Comments

Post a Comment